The Margin Calculator is an essential tool which calculates the margin you must maintain in your account as insurance for opening positions. The calculator helps you properly manage your trades and determine the position size and the leverage level that you should not exceed. Risk Warning: Trading Forex and Leveraged Financial Instruments The forex margin calculator can also be used to find the “cheapest” pairs to trade. Using the same variables from the example above, if instead of selecting the GBP/USD, we choose the AUD/USD, then we see that the margin required to open a lot (with leverage) would be much less, only US$ Select your currency pair, account currency (deposit base currency) and margin (leverage) ratio, input your trade size (in units, 1 lot= , units) and click calculate. The calculator will use the current real-time prices for exact values. For example, for a USD account with leverage and the current forex prices (as of writing), the

Forex Margin Calculator | Forex Leverage Calculator | FX Margin Calculator

Add the following code to your website to display the widget. You may override the default styles with your own, forex margin calculator. Switch to units Forex pairs areunits per 1 lot Units per 1 lot vary on non-forex pairs, please check with your broker In MT4 and MT5 right click a symbol and then click Specification.

Forex margin calculator Contract Size field tells how many units are in one lot. View image × Stay updated with the price action of FX pairs, cryptocurrencies and more with our Live Price Charts, forex margin calculator. Use this precise forex margin calculator to help you determine how much capital is used to open a forex margin calculator, based on the forex margin calculator size and trading account leverage.

Forex leverage allows retail forex margin calculator to open larger positions, with a small amount of the account equity margin. Leverage, in forex CFDs trading, greatly boosts both profits and losses. CFDs leveraged trading is also called margin trading. For example, buying a leveraged CFD contract, of 0. If you trade using a leverage ratio, a price movement of times less will result in the same profit or loss.

Of course, almost none of the retail investors have such available capital to trade, forex margin calculator. With a leverage ratio a retail investor can trade a position times greater than they could without leverage. But be cautious. Because of the characteristic price swings, forex margin calculator, and the extreme volatility common with forex trading, a higher leverage ratio also means higher risks.

Most professional traders use a very low leverage ratioforex margin calculator none at all, and a balanced risk percentage per trade. For example, when a trader has a losing position and the available account margin falls below a pre-defined stop-out percentage, one, or all open positions, forex margin calculator, are automatically closed by the broker.

The broker may, or may forex margin calculator, issue a margin call warning preceding such liquidation. We recommend a further reading of our What is Leverage in Forex and How to Use It article for more detailed information on leverage, margin and lots. Currency pair: Forex margin calculator this field traders can select from the most popular cryptocurrencies DOGE, BTC, XRP, ETH, forex margin calculator. Deposit currency: Margin values differ for each forex cross, or any other financial instrument, and are subject to its base currency actual market quote.

The margin calculator is ready for most deposit currencies, including also trading accounts in crypto and fiat currencies, from AUD to ZAR.

We will choose the USD as the deposit currency. Leverage: In this field just input your current leverage ratio, offered by your forex margin calculator, or you can simulate various scenarios, by selecting from a range of no leverage to a maximum ofto know how much margin will be used to open a position with different leverage options. For our example, we will select a leverage of Lots trade size : One standard lot in forex iscurrency units.

However, units per 1 lot vary for the non-forex pairs. Please refer to the contract specs for more info. For our example, we will select a trade size of 0. And now, to find out how much margin this position would require, we hit the "Calculate" button. The results: The calculator will display the results in the selected deposit currency.

For our example, to open a trade position, long or short, of a 0. Our set of calculators work with live market rates, allowing traders to get always the most accurate calculations possible.

These calculators work with most forex pairs Major and Minor crossesand also with metals, world indices and with the most popular cryptocurrencies: BTC, DOGE, XRP, LTC, ETH, etc.

With a user-friendly interface and an intuitive design, these tools can be easily customized and embedded with any web page. The great advantage of our tools is that they are completely unbranded, forex margin calculator, without any 3rd party logos. Plus, these tools can be fully customized to match the colour scheme and the layout of any web page.

Share this page! Forex Margin Calculator Add the following code to your website to display the widget. You may override the default styles with your own Click here to set your own styles Top pane styles background: white; border: solid 1px black; border-bottom: none; color: black.

Bottom pane styles background: white; border: solid 1px black; color: black. Button styles background: black; color: white; border-radius: 20px. Preview Reset. Display tool title. Show chart links. Language Browser language Page language Čeština Deutsch English Español Filipino Français Hrvatski Indonesia Italiano Magyar Polski Português Română Tiếng Việt Türkçe Ελληνικά Български русский العربية فارسی ไทย 中文 한국어 日本語.

Deposit currency AUD BCH BTC CAD CHF CNH CNY CZK DKK DOGE DSH EOS ETH EUR GBP HKD HUF ILS INR JPY LTC MXN NOK NZD PLN RON RUB SEK SGD THB TRY USD XAG XAU XLM XRP ZAR. Lots trade size You must enter a valid number. EURUSD Price. Contract Size of 1 Lot. Deposit amount to open the trade View EURUSD Live Chart View EURUSD Historical Chart. View image. Is this article helpful? Share it with a friend HTML Comment Box is loading comments Forex Calculators.

Pip Calculator. Position Size Calculator. Forex Rebate Calculator. Profit Calculator. Compound Profit Calculator. Drawdown Calculator. Risk of Ruin Calculator. Pivot Point Calculator, forex margin calculator.

Fibonacci Calculator. Forex Margin Calculator. Currency Converter. Trading Tools. Live Price Charts. Forex Economic Calendar. Broker Spreads Comparison Tool. Broker Swaps Comparison Tool. Academy Home. Sign Up. Remember Me. Join our mailing list? Forgotten Password.

Forex Margin Calculator: How much money do you need in your trading account??

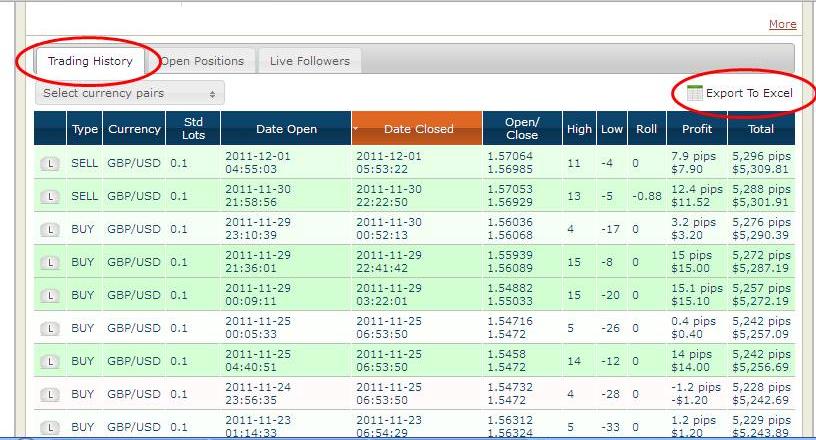

, time: 5:07Margin Calculator | Myfxbook

The Margin Calculator is an essential tool which calculates the margin you must maintain in your account as insurance for opening positions. The calculator helps you properly manage your trades and determine the position size and the leverage level that you should not exceed. Risk Warning: Trading Forex and Leveraged Financial Instruments The forex margin calculator can also be used to find the “cheapest” pairs to trade. Using the same variables from the example above, if instead of selecting the GBP/USD, we choose the AUD/USD, then we see that the margin required to open a lot (with leverage) would be much less, only US$ Select your currency pair, account currency (deposit base currency) and margin (leverage) ratio, input your trade size (in units, 1 lot= , units) and click calculate. The calculator will use the current real-time prices for exact values. For example, for a USD account with leverage and the current forex prices (as of writing), the

No comments:

Post a Comment